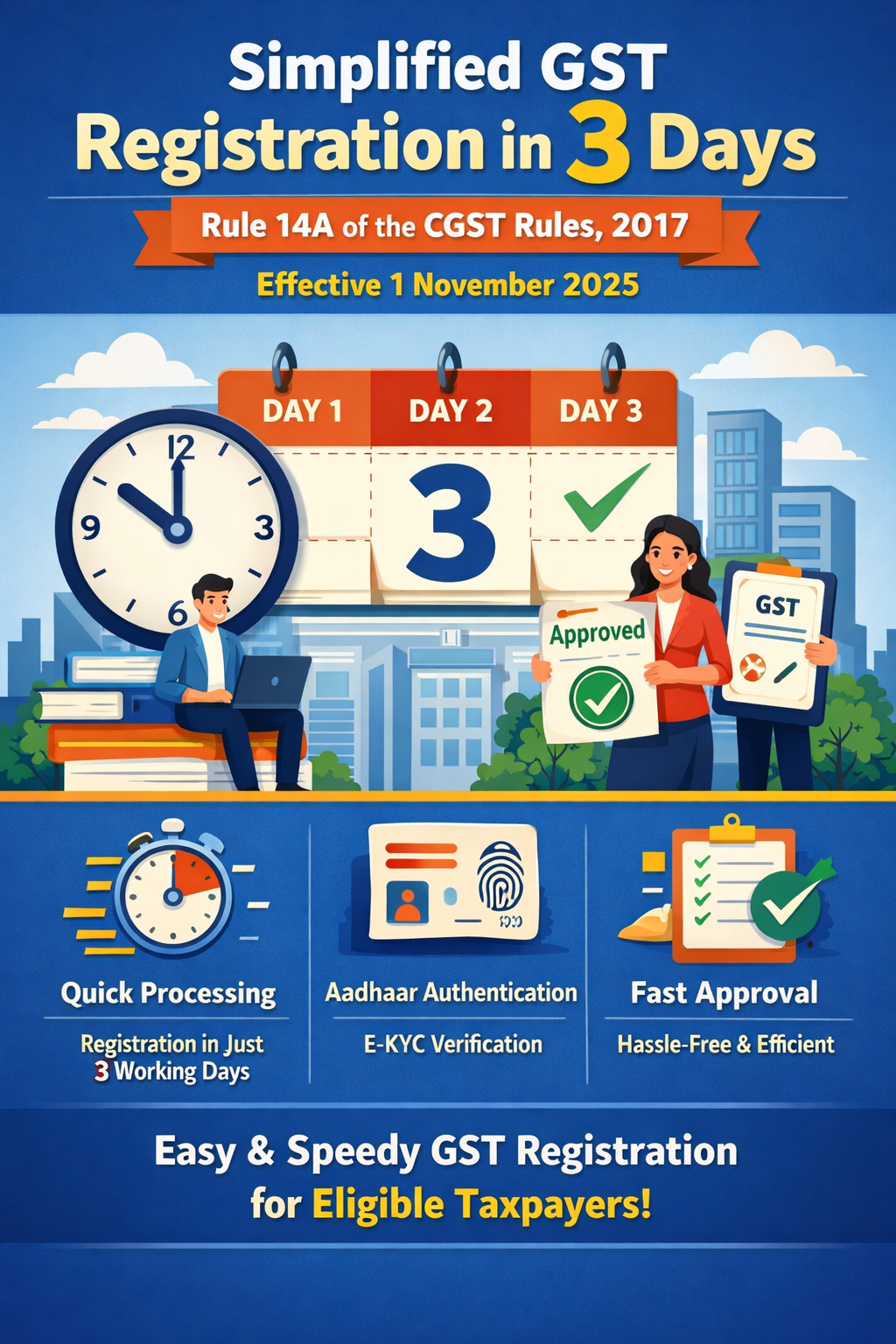

Rule 14A of the CGST Rules, 2017

Simplified GST Registration in 3 Days: Rule 14A of the CGST Rules, 2017 (Effective 1 November 2025) The Government has introduced a significant compliance reform

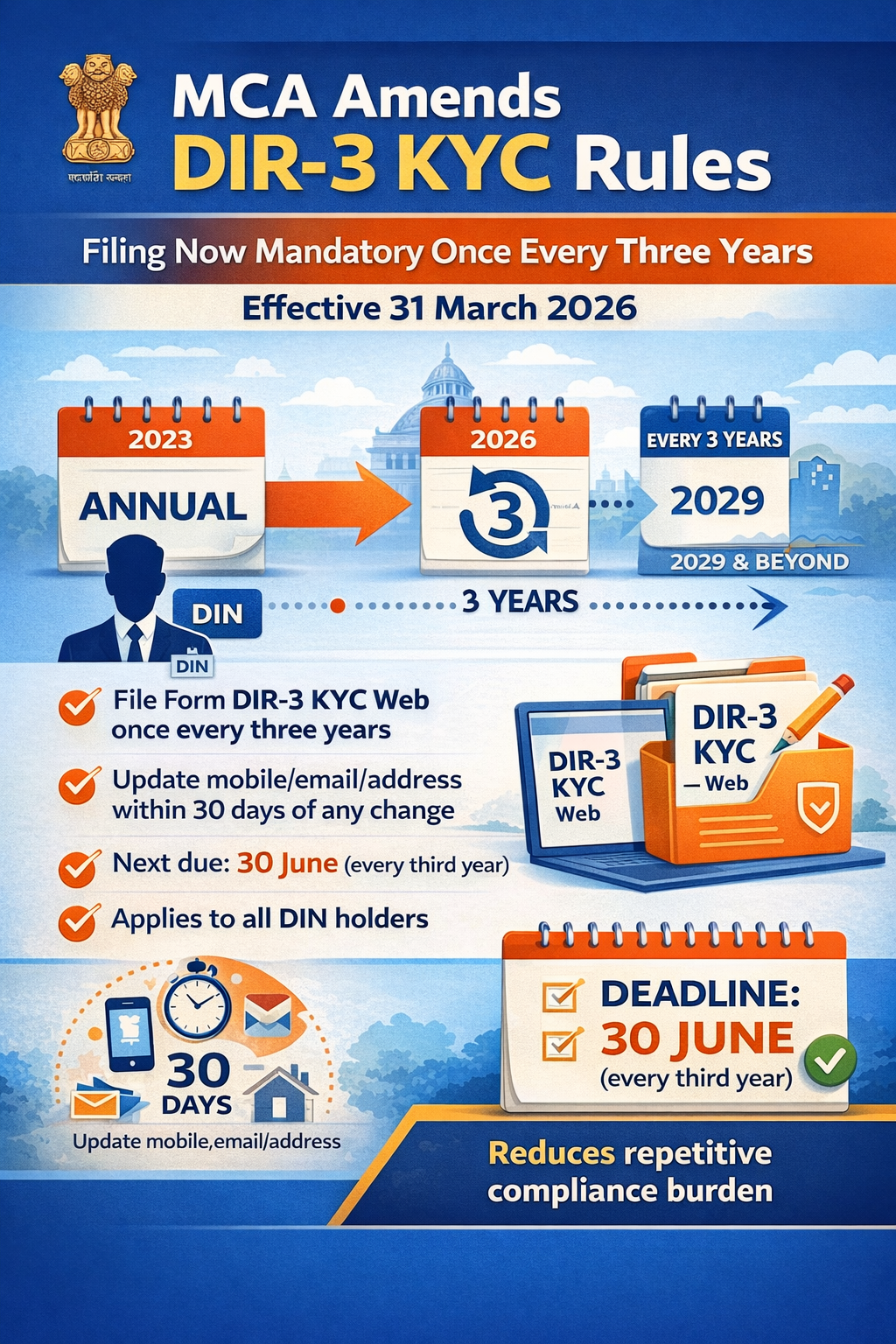

MCA Amends DIR-3 KYC Rules: Filing Now Mandatory Once Every Three Years (Effective 31 March 2026)

The Ministry of Corporate Affairs (MCA) has notified a significant amendment to the Companies (Appointment and Qualification of Directors) Rules, 2014, bringing major relief to

Final Deadline for TDS/TCS Corrections – Act Before 31-03-2026

Final Deadline for TDS/TCS Corrections – Act Before 31-03-2026 The Income-tax compliance landscape is undergoing a significant transition. A crucial deadline is approaching that every