The Ministry of Corporate Affairs (MCA) has notified a significant amendment to the Companies (Appointment and Qualification of Directors) Rules, 2014, bringing major relief to directors across India.

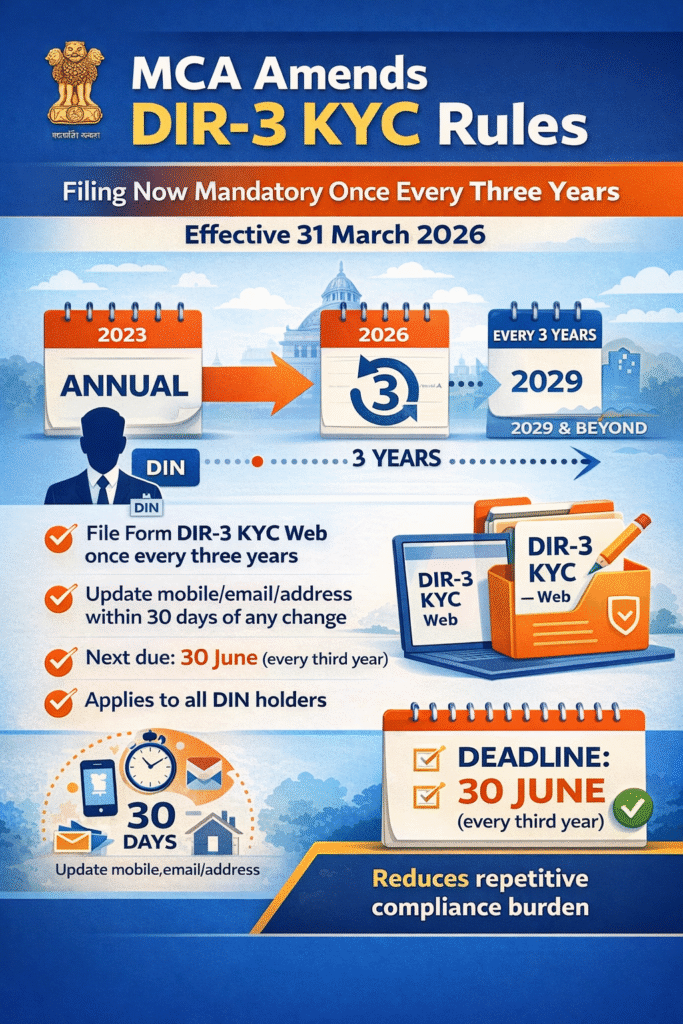

Effective 31 March 2026, the requirement of filing DIR-3 KYC annually has been replaced with a triennial (once every three years) compliance requirement.

This move reduces repetitive compliance while strengthening accountability in maintaining updated director information.

🔎 What Has Changed?

1️⃣ DIR-3 KYC Now Required Once Every Three Years

Earlier, every director holding a valid DIN was required to file DIR-3 KYC annually.

Now, directors must file the DIR-3 KYC Web Form once every three financial years.

This significantly reduces the yearly compliance burden for companies and professionals.

2️⃣ New Due Date – 30th June of the Relevant Year

The DIR-3 KYC Web Form must be filed on or before 30th June of the third financial year.

Failure to comply within this timeline will trigger compliance consequences.

3️⃣ Mandatory Update Within 30 Days for Contact Changes

If there is any change in the director’s mobile number or email ID, the director must update the details through the DIR-3 KYC Web Form within 30 days of such change.

This ensures real-time accuracy of MCA records.

4️⃣ Only Web-Based Filing Allowed

The MCA has clarified that:

a) Filing shall be done only through the DIR-3 KYC Web Form

b) Earlier e-form filing options have been discontinued

c) This indicates complete digitisation and streamlined verification.

⚠️ Consequences of Non-Compliance

If DIR-3 KYC is not filed within the prescribed timeline:

a) The DIN (Director Identification Number) will be deactivated

b) The director will be unable to file any MCA forms

c) Companies may face delays in statutory filings

d) Reactivation may require additional fees and procedural compliance.

📅 Transitional Provision – Important for Existing Directors

For directors who have already completed their KYC prior to this amendment:

👉 Their next filing will be due on or before 30 June 2028.

This provides clarity and avoids confusion during the transition period.

🎯 Practical Implications for Companies & Professionals

✔ Reduced repetitive annual compliance

✔ Need to track a 3-year compliance cycle carefully

✔ Immediate action required upon change in mobile/email

✔ Internal compliance calendars must be updated