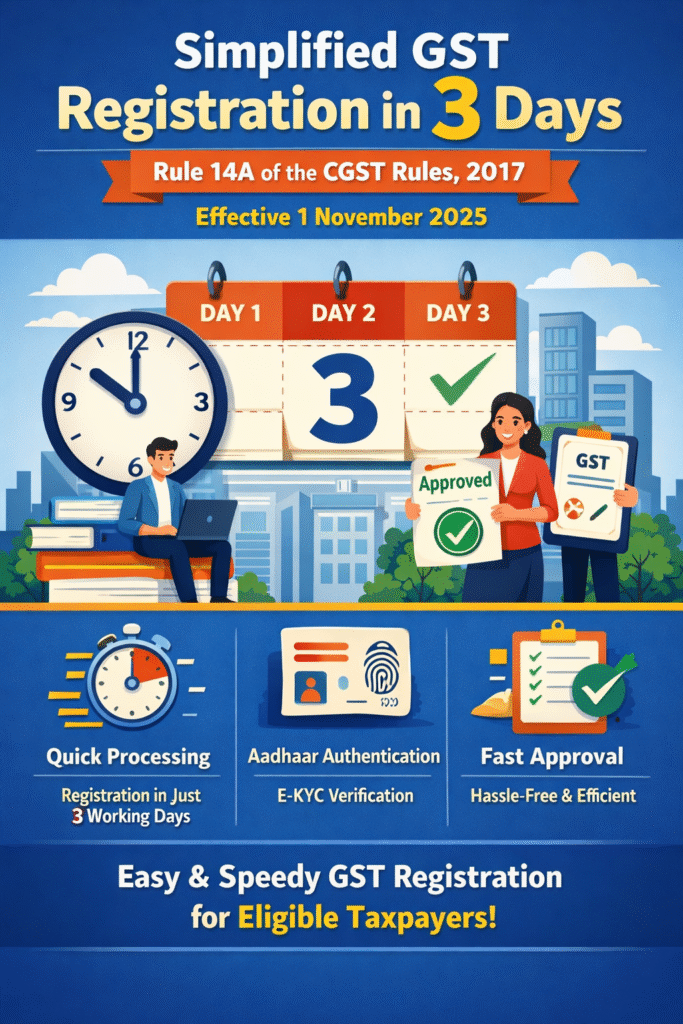

Simplified GST Registration in 3 Days: Rule 14A of the CGST Rules, 2017 (Effective 1 November 2025)

The Government has introduced a significant compliance reform under Rule 14A of the CGST Rules, 2017, effective 1st November 2025, providing a Simplified GST Registration Scheme for eligible small taxpayers.

This amendment aims to reduce procedural delays and improve ease of doing business by enabling GST registration approval within 3 working days.

Let us understand the provision in detail.

Background

Under the existing GST framework, registration timelines often vary depending on document verification, officer scrutiny, and procedural checks. This sometimes results in delays, affecting business operations — especially for small and medium enterprises.

To address this issue, Rule 14A introduces a fast-track registration mechanism for small taxpayers with limited B2B tax exposure.

✅ Key Highlights of Rule 14

1️⃣ Eligibility Criteria

A person applying for GST registration will be eligible for the simplified process if:

The monthly B2B output tax liability (CGST + SGST + IGST) is less than ₹2.5 lakh, and

The applicant is registering as a regular taxable person (not under composition, casual taxable person, etc.).

🔎 Important Clarification:

The threshold is based on monthly output tax liability on B2B supplies, not turnover.

2️⃣ Day Approval Timeline

Under this simplified scheme:

The Proper Officer must process and approve the GST registration application within 3 working days from the date of filing (provided the application is complete in all respects).

If no action is taken within 3 working days, the registration shall be deemed approved automatically.

This deemed approval mechanism significantly reduces uncertainty for new businesses.

3️⃣ Streamlined Documentation & Verification

The objective of Rule 14A is procedural simplification:

Reduced documentation burden at the registration stage.

Limited intrusive verification.

Faster onboarding into the GST ecosystem.

However, post-registration compliance requirements remain unchanged.

📊 Before vs After Rule 14A

Particulars Earlier Framework Post Rule 14A (from 1 Nov 2025) Registration Timeline Variable Maximum 3 working days Deemed Approval Not specifically mandated Yes, after 3 days Eligibility Condition No tax-based threshold B2B output tax liability < ₹2.5 lakh per month

Compliance Post Registration Regular GST compliance Regular GST compliance

⚠ Important Considerations

The ₹2.5 lakh limit applies only to B2B output tax liability, not total turnover.

This is not a new GST scheme like the Composition Scheme.

Once registered, the taxpayer must comply with all regular GST return filing and payment provisions.

🎯 Practical Impact for Businesses

This amendment is particularly beneficial for:

- Start-ups

- Small service providers

- Small traders dealing primarily in B2B transactions

- Professionals setting up new practice entities

Faster registration means:

✔ Quicker GSTIN allotment

✔ Faster invoicing capability

✔ Reduced business disruption

✔ Improved working capital cycle